Last Updated: December 3, 2024

Hourly to Salary Calculator

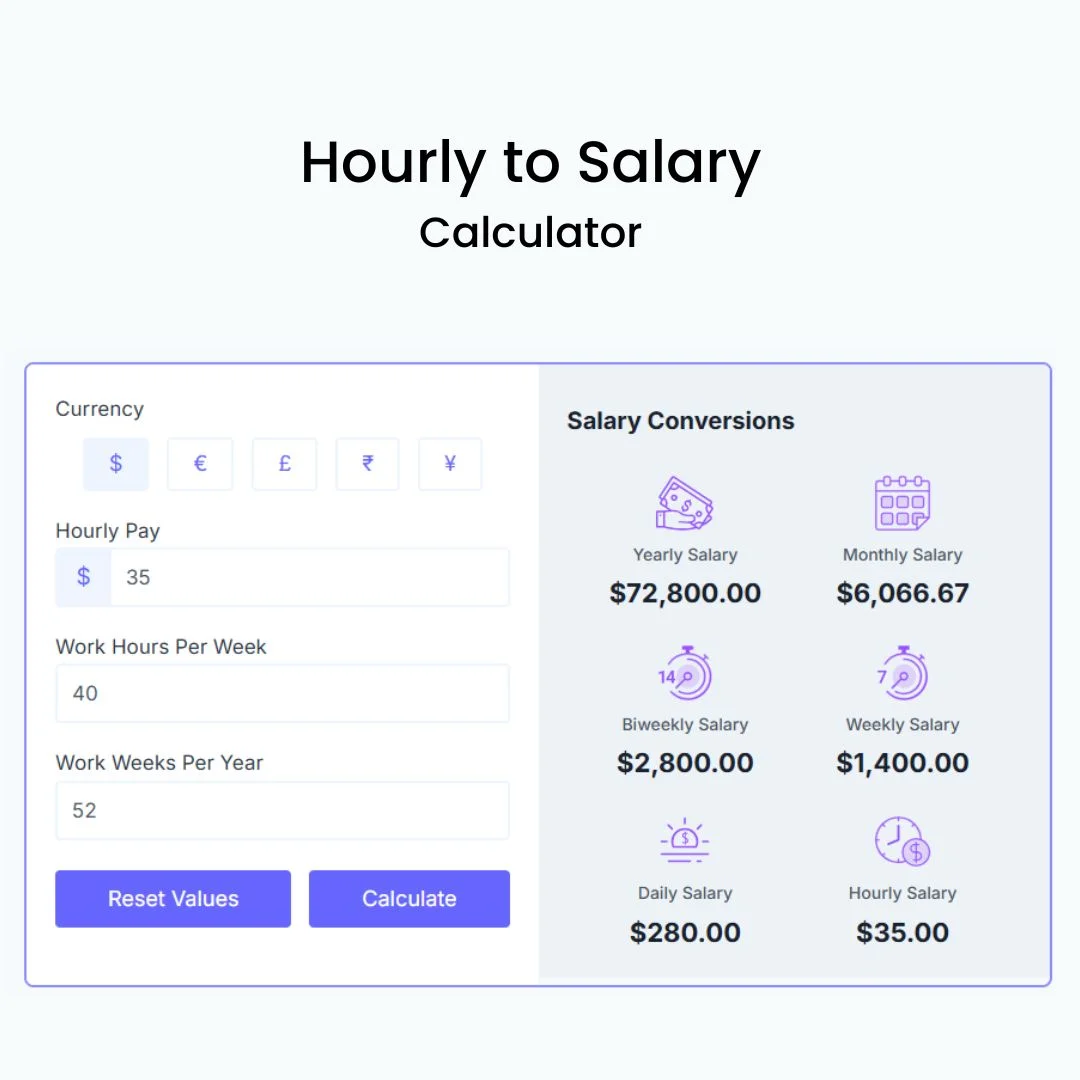

Convert your hourly wage into a complete pay breakdown showing your annual salary, monthly income, biweekly paycheck, weekly earnings, and daily pay

Hourly Conversions

Have you ever looked at a job offer with an hourly rate and wondered about your potential yearly income? You’re in good company – 59% of American workers receive hourly wages, and many find it challenging to calculate their annual earnings.

The process of converting hourly wages to salary involves more than simple multiplication of 40 hours and 52 weeks. Several factors like overtime, paid time off, and benefits can complicate these calculations. A hourly to salary calculator can be your most reliable tool in this situation.

Are you ready to become skilled at salary calculations? Let’s take a closer look!

What is an Hourly to Salary Calculator

The hourly to salary calculator makes wage calculations simple and helps convert hourly wages into annual, monthly, weekly, biweekly, or daily salary figures.

The calculator multiplies your hourly rate by the number of hours worked per year. The accuracy comes from its ability to include variables like holidays and vacation time.

These features make this calculator a great way to get insights:

You just need to enter your hourly pay rate and average weekly hours into the calculator. The tool handles everything else. To name just one example, a full-time job at $15.00 per hour translates to an annual pre-tax salary of $31,200.00.

The calculator serves both employees and employers effectively. Companies use it to calculate annual salary figures and adjust for workers’ overhead expenses. The tool becomes especially valuable when you have to factor in overtime eligibility – which applies to employees earning less than $23,660.00 per year.

Hourly Conversion Chart

Hourly, Annual, Monthly and Weekly Pay

Based on 40-Hour Work Week & 52 Weeks Per Year

| Hourly Rate | Annual Salary | Monthly Salary | Weekly Pay |

|---|---|---|---|

| $15 | $31,200 | $2,600 | $600 |

| $16 | $33,280 | $2,773 | $640 |

| $17 | $35,360 | $2,947 | $680 |

| $18 | $37,440 | $3,120 | $720 |

| $19 | $39,520 | $3,293 | $760 |

| $20 | $41,600 | $3,467 | $800 |

| $21 | $43,680 | $3,640 | $840 |

| $22 | $45,760 | $3,813 | $880 |

| $23 | $47,840 | $3,987 | $920 |

| $24 | $49,920 | $4,160 | $960 |

| $25 | $52,000 | $4,333 | $1,000 |

| $26 | $54,080 | $4,507 | $1,040 |

| $27 | $56,160 | $4,680 | $1,080 |

| $28 | $58,240 | $4,853 | $1,120 |

| $29 | $60,320 | $5,027 | $1,160 |

| $30 | $62,400 | $5,200 | $1,200 |

| $31 | $64,480 | $5,373 | $1,240 |

| $32 | $66,560 | $5,547 | $1,280 |

| $33 | $68,640 | $5,720 | $1,320 |

| $34 | $70,720 | $5,893 | $1,360 |

| $35 | $72,800 | $6,067 | $1,400 |

| $36 | $74,880 | $6,240 | $1,440 |

| $37 | $76,960 | $6,413 | $1,480 |

| $38 | $79,040 | $6,587 | $1,520 |

| $40 | $83,200 | $6,933 | $1,600 |

| $42 | $87,360 | $7,280 | $1,680 |

| $43 | $89,440 | $7,453 | $1,720 |

| $45 | $93,600 | $7,800 | $1,800 |

| $50 | $104,000 | $8,667 | $2,000 |

| $55 | $114,400 | $9,533 | $2,200 |

| $60 | $124,800 | $10,400 | $2,400 |

| $65 | $135,200 | $11,267 | $2,600 |

| $70 | $145,600 | $12,133 | $2,800 |

| $75 | $156,000 | $13,000 | $3,000 |

Hourly To Salary Calculation Formula

The ability to convert hourly wages into salary figures helps us make smarter career decisions. A simple multiplication forms the starting point, and several factors need to be factored in for accuracy.

The basic formula we use is:

Annual Salary = Hourly Rate × Hours Per Week × (52 weeks – PTO weeks)

Let’s break down the standard formula to calculate annual salary:

- Basic Annual Calculation: Hourly Rate × Hours Per Week × 52 weeks

- Adjusted Annual Calculation: Hourly Rate × Hours Per Week × (52 weeks – PTO weeks)

- Monthly Calculation: Annual Salary ÷ 12

- Weekly Calculation: Annual Salary ÷ 52

A standard 40-hour workweek allows us to use these quick multipliers:

To name just one example, see someone earning $20 per hour in a full-time position. Their annual salary calculation would be: $20 × 40 hours × 52 weeks = $41,600

Pre-tax Figures

Note that these figures represent pre-tax amounts and don’t include variables like overtime, bonuses, or benefits. A more precise calculation needs many more elements that we’ll explore in the next sections.

Step-by-Step Calculation Guide

Let’s explore how to use an hourly to salary calculator after learning the simple formula. This guide will help you get accurate results.

Gathering Required Information

You’ll need some key details to start your calculations. The simple things you need are your hourly wage and weekly work hours.

Using Simple Calculator Functions

Here’s what you need to do:

- Type in your hourly rate

- Add your weekly work hours (40 hours for full-time jobs)

- Put in your yearly work weeks (52 weeks is standard)

- Look at what you’ll earn in different time periods

Accounting for Variables and Adjustments

Your final salary calculation depends on several things:

A good salary estimate needs all these details in your calculator. To cite an instance, working 40 hours weekly at $15.00 per hour gives you $31,200.00 yearly. This number might change with overtime or bonuses.

You should pick a trusted calculator and double-check your numbers. This way, you’ll avoid mistakes and get a clear picture of what you can earn.

Handling Special Scenarios

Salary calculations from hourly wages often involve special situations that need extra attention. Let’s look at how to handle these unique scenarios the right way.

Part-time and Variable Hours

Our calculations need adjustments based on actual hours worked in part-time positions. To name just one example, working 26 hours weekly at $11.00 per hour would result in monthly earnings of approximately $1,144.00. Variable schedules require us to average our hours across several weeks to get a realistic picture of what we might earn.

Overtime and Holiday Pay

Accurate salary estimates depend on proper overtime calculations. The Fair Labor Standards Act (FLSA) mandates employers to pay 1.5 times our regular wage beyond 40 weekly hours. A worker making $14.00 per hour and working 47 hours would earn $707.00 weekly (40 regular hours plus 7 overtime hours).

Holiday pay brings additional complexity to our calculations. Some employers offer holiday premium rates, though U.S. law doesn’t require them. Here’s what matters:

Benefits and Additional Compensation

Total compensation goes beyond the basic hourly-to-salary conversion and includes:

Benefits can change our total compensation package by a lot. Our employer’s contribution to benefits worth 35% of base salary becomes a key factor in calculating overall earnings.

How many hours is full-time employment?

Understanding full-time employment hours plays a significant role in salary calculations since organizations measure work hours differently. The Fair Labor Standards Act (FLSA) doesn’t give us a strict definition, but we have several important standards to think about.

The IRS will call it full-time employment if we work at least 30 hours per week or 130 hours per month. Most employment practices show full-time hours range between 35 to 45 hours per week.

These standards help define full-time work:

Full-time employment makes up 82.7% of all employment in the United States as of October 2024. This high percentage shows why we need to understand full-time classifications when using our hourly to salary calculator.

Our annual salary calculations depend on whether employers use monthly measurement or look-back measurement methods to determine full-time status. This becomes especially important when you have benefits and overtime calculations in your salary conversions.

Practical Example Calculations

Let’s take a closer look at practical calculations with ground examples to understand how hourly wages translate into different salary periods. These examples will help you become skilled at the conversion process.

How to Calculate Annual/Yearly Salary from Hourly Rate?

The annual salary calculation requires multiplying the hourly rate by working hours per week and then by 52 weeks. A person earning $20.00 per hour working 40 hours weekly would have an annual salary of $41,600.00.

How to Calculate Half-Yearly Salary from Hourly Rate?

Half-yearly salary calculations need the annual figure divided by 2. Someone working 20 hours per week at $25.00 hourly rate would earn $26,000.00 half-yearly.

How to Calculate Monthly Salary from Hourly Rate?

Two reliable methods exist to calculate monthly salary:

To cite an instance, see how $30.00 per hour yields a monthly pre-tax salary of $5,000.00.

How to Calculate Weekly Salary from Hourly Rate?

Weekly salary calculations are simple and direct. Multiply the hourly rate by hours worked per week. An employee working 40 hours at $18.00 per hour would earn $720.00 weekly.

How to Calculate Daily Salary from Hourly Rate?

Daily rates depend on hours worked each day. An 8-hour workday at $30.00 per hour results in a daily rate of $240.00. Annual working days can vary:

| Working Days/Year | Daily Rate Calculation |

|---|---|

| 200 days | Annual salary ÷ 200 |

| 250 days | Annual salary ÷ 250 |

| 260 days | Annual salary ÷ 260 |

Benefits of Salary to Hourly Calculator

A salary calculator does much more than simple wage conversions. These tools are a great way to get resources for employees and employers in the ever-changing workplace.

The calculator brings precision to financial planning and helps users avoid mistakes in manual calculations. People can make informed decisions about their career opportunities because these tools give clear comparisons between different compensation packages.

These calculators offer several advantages:

These calculators play a vital role in ensuring fair compensation. Employers use them as essential tools to stay transparent and compliant with labor laws. This transparency results in better employee morale and helps retain talent in organizations.

Making Informed Career Decisions

Smart career moves need more than simple salary math. Our experience shows that salary calculators can change how we make career decisions.

Comparing Job Offers

You need to look beyond the simple hourly rate when evaluating job opportunities. A salary calculator helps you compare total compensation packages. Here are the things to think about:

Negotiating Compensation Packages

The data from our calculations puts us in a better position to negotiate. Research shows that people who start negotiations with clear, informed expectations are more likely to get fair compensation. The timing of these discussions is vital – performance reviews give you the best chance to talk about moving from hourly to salary pay.

Planning Career Advancement

Your career growth strategy should match market standards and industry trends. Salaried positions usually come with a pay scale that offers promotion opportunities based on your experience and time with the company. We’ve found that annual salaries often come with permanent positions that people call career options.

Salary calculators help you plan for the future and project your earnings based on industry growth and education. This information helps you make smart choices about investing in professional development, such as getting advanced degrees or certifications that could increase your earning potential.

Conclusion

Converting hourly wages to salary gives us the ability to control our career decisions and financial planning. These calculations do more than simple multiplication – they help us review total compensation packages, plan our budgets, and negotiate better job offers.

Salary calculators make complex calculations simple and account for variables like overtime, benefits, and paid time off. These tools are essential for employees and employers who need to make informed wage decisions.

Note that accurate salary information leads to smart career moves. Comparing job offers, planning career advancement, and budgeting for the future helps us achieve professional goals and secure fair compensation effectively.