Last Updated: December 2, 2024

Salary to Hourly Calculator

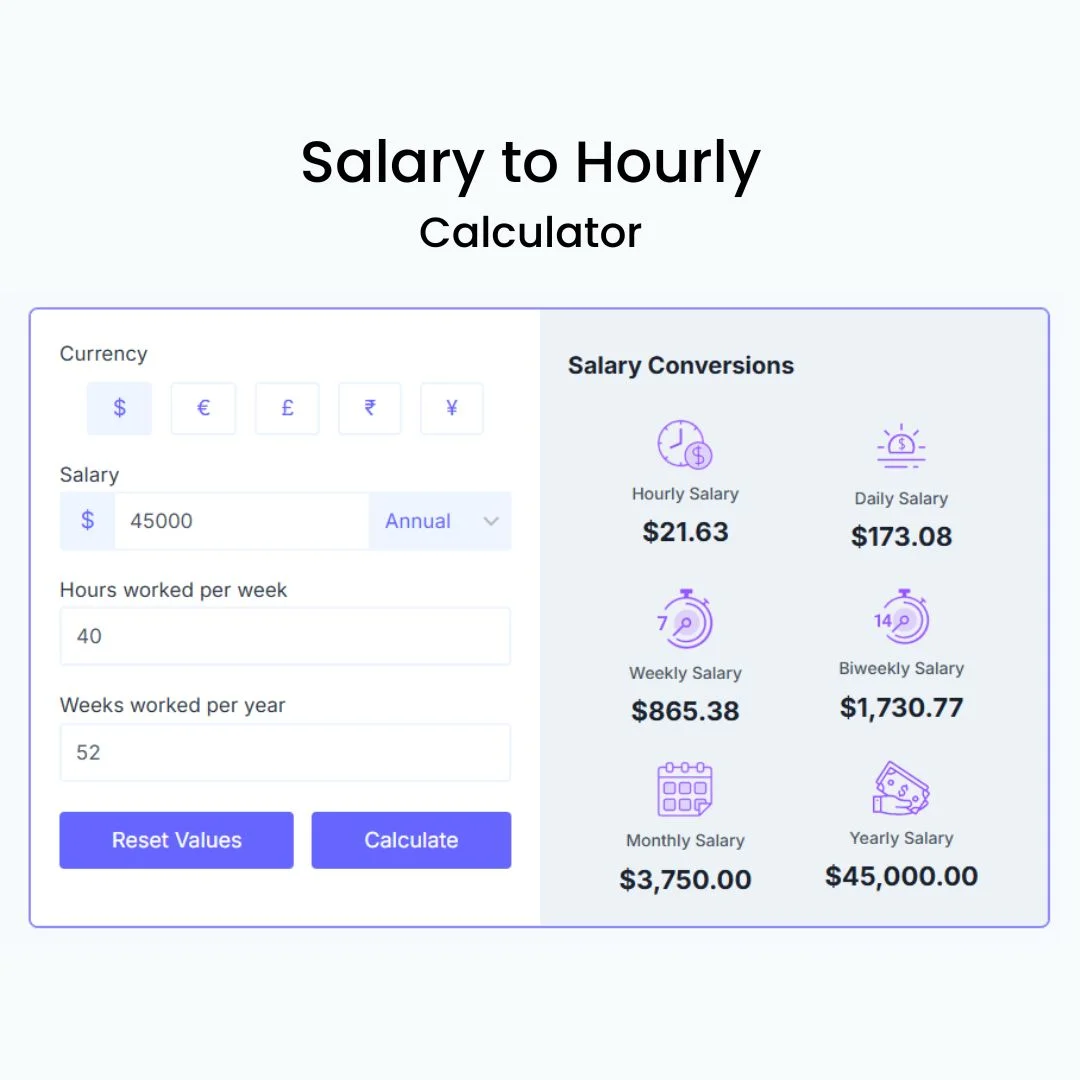

Calculate your hourly rate from your annual salary with a complete breakdown showing your daily pay, weekly earnings, biweekly paycheck, and monthly income

Salary Conversions

Last Updated: December 2, 2024

Salary to Hourly Calculator

Salary Conversions

Calculate your hourly rate from your annual salary with a complete breakdown showing your daily pay, weekly earnings, biweekly paycheck, and monthly income

Have you ever looked at a job offer and felt puzzled about whether $50,000 per year beats $24 per hour? Don’t worry – you’re not the only one.

Most professionals face this challenge. Many great opportunities slip away because people misunderstand their compensation packages.

A Salary to Hourly Calculator solves this problem perfectly. This simple and quick tool shows your yearly, monthly, weekly, biweekly, or daily salary as an hourly rate. It provides quick answers while you compare job offers, discuss your pay, or calculate your hourly worth.

How Salary to Hourly Calculator Works?

Our salary to hourly calculator makes wage calculations simple and quick. You can convert between different pay frequencies effortlessly with this smart tool.

The calculator needs only two key pieces of information to work: your weekly working hours and one type of wage (annual, monthly, weekly, biweekly, or daily). A standard 40-hour workweek serves as the default setting, which you can adjust based on your needs.

This calculator works in these simple steps:

A $40,000 annual salary with a 40-hour workweek translates to $19.23 per hour. The same calculation shows that a $50,000 yearly salary equals $24.04 per hour.

The calculator’s flexibility makes it a valuable tool. Your hourly rate appears instantly whether you receive weekly, biweekly, monthly, or yearly payments. Your annual salary divided by total yearly working hours (weekly hours × 52 weeks) gives you the exact rate.

Manual calculations take nowhere near the time and effort of this automated tool. Job seekers find it helpful when comparing different offers or understanding their earning potential across various pay formats. The tool adapts to your specific working hours and delivers accurate results no matter your schedule.

Salary Conversion Chart

Annual, Hourly, Weekly, and Monthly Pay Rates

Based on 40-Hour Work Week & 52 Weeks Per Year

| Annual Salary | Hourly Rate | Weekly Salary | Monthly Salary |

|---|---|---|---|

| $30,000 | $14.42 | $576.92 | $2,500.00 |

| $35,000 | $16.83 | $673.08 | $2,916.67 |

| $40,000 | $19.23 | $769.23 | $3,333.33 |

| $42,000 | $20.19 | $807.69 | $3,500.00 |

| $44,000 | $21.15 | $846.15 | $3,666.67 |

| $45,000 | $21.63 | $865.38 | $3,750.00 |

| $46,000 | $22.12 | $884.62 | $3,833.33 |

| $47,000 | $22.60 | $903.85 | $3,916.67 |

| $50,000 | $24.04 | $961.54 | $4,166.67 |

| $52,000 | $25.00 | $1,000.00 | $4,333.33 |

| $55,000 | $26.44 | $1,057.69 | $4,583.33 |

| $60,000 | $28.85 | $1,153.85 | $5,000.00 |

| $65,000 | $31.25 | $1,250.00 | $5,416.67 |

| $67,000 | $32.21 | $1,288.46 | $5,583.33 |

| $70,000 | $33.65 | $1,346.15 | $5,833.33 |

| $75,000 | $36.06 | $1,442.31 | $6,250.00 |

| $80,000 | $38.46 | $1,538.46 | $6,666.67 |

| $85,000 | $40.87 | $1,634.80 | $7,083.33 |

| $90,000 | $43.27 | $1,730.77 | $7,500.00 |

| $100,000 | $48.08 | $1,923.08 | $8,333.33 |

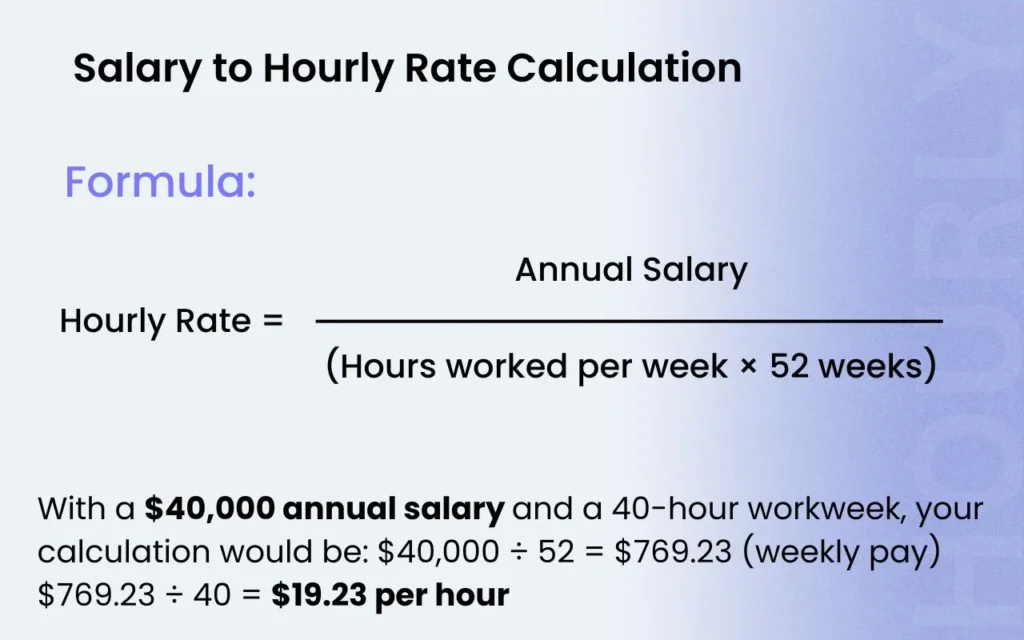

Salary to Hourly Rate Calculation Formula

Salary conversions and their underlying math help us make smarter financial decisions. Here’s a guide to the essential formulas that convert your salary into an hourly rate.

The basic formula we use is:

Hourly Rate = Annual Salary ÷ (Hours worked per week × 52 weeks)

A standard 40-hour workweek allows this simple calculation: Hourly Rate = Annual Salary ÷ 2,080 (where 2,080 represents total working hours in a year)

The calculation process breaks down into these simple steps:

- Calculate your weekly pay by dividing annual salary by 52

- Determine your average weekly working hours

- Divide weekly pay by hours worked

- Account for any overtime hours if applicable

A practical example shows how this works. With a $40,000 annual salary and a 40-hour workweek, your calculation would be: $40,000 ÷ 52 = $769.23 (weekly pay) $769.23 ÷ 40 = $19.23 per hour

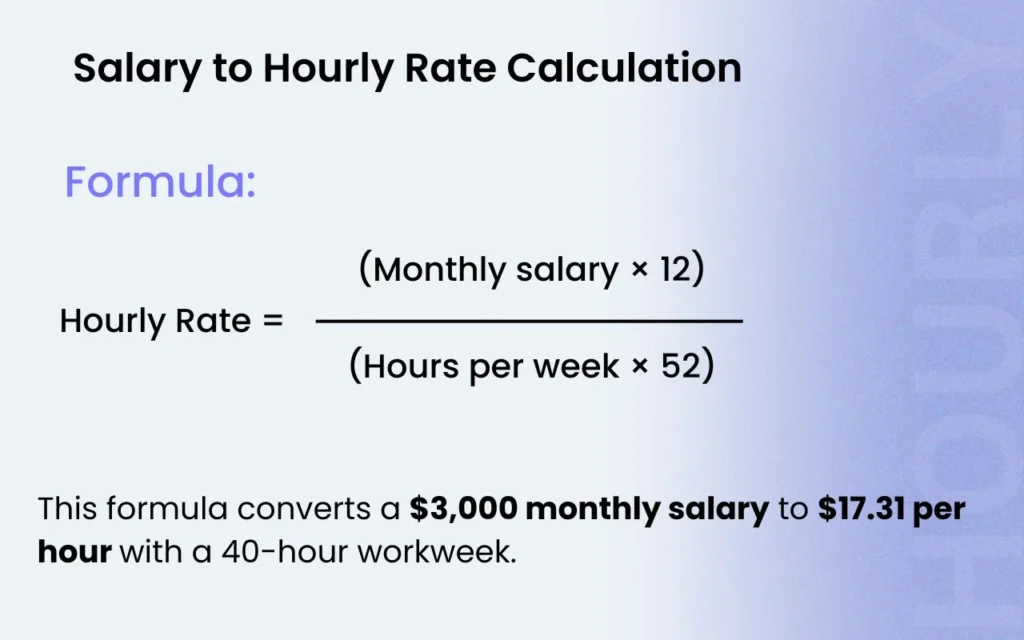

Monthly salaries need a slightly different approach:

Hourly Rate = (Monthly salary × 12) ÷ (Hours per week × 52)

This formula converts a $3,000 monthly salary to $17.31 per hour with a 40-hour workweek.

Pre-tax Figures

Note that these calculations show pre-tax figures and assume a consistent work schedule. Our salary to hourly calculator provides more accurate results and handles these computations instantly while accounting for various pay frequencies and work schedules.

Different Pay Frequencies

Our salary to hourly calculator helps you understand different pay frequencies to get accurate conversions. Let me walk you through the four main types of pay frequencies and their impact on calculations.

The Bureau of Labor Statistics shows how companies pay their employees:

- Biweekly: Most common at 43% of businesses

- Weekly: Second most popular at 33.3% of companies

- Semimonthly: Used by 19% of employers

- Monthly: Least common at 4.7%

Weekly Pay

Weekly pay gives you 52 paychecks each year and the most frequent access to wages. Construction and manufacturing industries often use this frequency because employees get paid for individual jobs.

Biweekly Payments

Biweekly payments give you 26 paychecks yearly that land on the same day every other week. The sort of thing I love about this schedule is that you get three paychecks instead of two in two months of the year. This helps a lot with budgeting.

Semimonthly Payments

Semimonthly payments result in 24 paychecks per year. Employees usually receive these on fixed dates like the 15th and 30th of each month. This might look like in biweekly payments, but the core team notices a difference – payment dates can fall on different weekdays, and some employees find this hard to track.

Monthly Payments

Monthly payments give you the largest single paycheck but make financial planning harder. You get 12 paychecks yearly with this schedule, which is common in salaried positions.

The calculator adjusts to your specific pay frequency automatically. You’ll get precise conversions whatever your payment schedule looks like.

Salary to Hourly Paycheck Calculation

Let’s walk through the process of calculating your actual paycheck with our salary to hourly calculator. You’ll learn to handle different scenarios that affect your calculations.

The simple method divides an annual salary by working hours in a year. To cite an instance, a salary of $31,200 annually equals a weekly wage of $600 ($31,200 ÷ 52 weeks), which gives an hourly rate of $15.00 ($600 ÷ 40 hours).

The calculations become more detailed with overtime. Here’s the process:

- Calculate regular weekly earnings (40 hours × hourly rate)

- Determine overtime rate (regular rate × 1.5)

- Calculate overtime wages (overtime rate × extra hours)

- Add regular and overtime wages

A practical example shows this clearly: With a $31,200 salary and 45 weekly hours, your figures would be:

- Regular weekly earnings: $600 (40 hours × $15.00)

- Overtime rate: $22.50 ($15.00 × 1.5)

- Weekly overtime wages: $112.50 ($22.50 × 5 hours)

- Total weekly earnings: $712.50

Your yearly earnings could reach $37,050 with this overtime work, which adds $5,850 to your base salary.

Salary Range

Both employers and job seekers need this information to make informed decisions. These ranges give room to negotiate and help ensure fair pay in similar roles.

A salary range typically has three key levels:

The US median salary currently stands at $63,795 per year. This figure helps companies set baseline ranges to compensate employees fairly. A position with an annual range of $20,000 to $30,000 translates to $9.62 to $14.42 per hour based on a 40-hour workweek.

Salary ranges give both sides room to negotiate effectively. To cite an instance, a $50,000 annual salary converts to $24.04 per hour. This figure can shift 10-15% up or down based on your qualifications and experience.

Companies now embrace pay transparency more than ever. 98% of workers believe job postings should list pay ranges. This openness brings positive change – Colorado saw posted salaries rise by 3.6% on average after implementing pay transparency laws.

Your position in a salary range depends on several factors:

The government service provides a good example of structured pay. A GS-9 position starts at $68,405 yearly, which equals $32.78 per hour. This shows how well-defined salary ranges create clear career paths while keeping pay fair and competitive.

Hourly Workers vs Salaried Workers

The differences between hourly rates, monthly salaries, and annual compensation helps you make better career decisions. The latest data reveals that 55.8% of the U.S. workforce earns hourly wages instead of salaries. This number shows how varied today’s job market has become.

These are the main differences:

1. Hourly Workers:

2. Salaried Workers:

Salaried positions give you more stability with a fixed monthly amount whatever your working hours. To cite an instance, a $60,000 annual salary gives you $5,000 monthly before taxes.

Hourly employees find it easier to keep work and personal life separate. They can spend time with family, pursue hobbies, or work another job after hours. Salaried workers often struggle to set clear boundaries between work and personal time.

Companies find hourly positions give them more control over labor costs. They can adjust working hours in slow periods, while cutting a salaried position needs more effort. This flexibility can mean less stable income for hourly workers.

Salary vs Hourly Pros and Cons

Your career trajectory and work-life balance depend heavily on choosing between salary and hourly employment. A detailed analysis of each payment structure’s pros and cons will help you make an informed decision.

Salaried Positions Benefits and Drawbacks

Hourly Positions Benefits and Drawbacks

Research shows that 98% of salaried employees receive detailed benefits packages. Hourly workers, on the other hand, often control their time better and can boost their income through overtime work.

Benefits of Salary to Hourly Calculator

This salary to hourly calculator does more than convert numbers – it becomes your partner to make smart financial decisions. We built it to give you a complete picture that affects your career and money planning.

Our calculator brings several benefits that are a great way to get ahead professionally:

- Better Financial Planning: Your salary conversion lets you track monthly and weekly income with ease. This makes budgeting much simpler

- Better Negotiations: You’ll know your true hourly worth and can use this knowledge during salary talks

- Tax Management: The right conversions help you set correct tax withholdings and stay within regulations

- Industry Comparisons: You can review different job offers and industry standards with better accuracy

- Overtime Calculations: Businesses can figure out the right overtime rates, usually at 1.5 times the base rate